It used to be that investors viewed volatility as simply a risk to the predictability of a price at any given moment. But increasingly, investors view volatility investments as a way to protect against downside or as investments in themselves. The most popular way to measure volatility is to use the VIX Index. The VIX is a derivative of a derivative; the math is beyond the understanding of most people. When investors are expecting a stable market, the VIX is low and the opposite is true when how to make money trading the vix are expecting instability. The historical average value of the VIX is around 20, although it has spiked beyond in shock events like the Asian financial crisis, the global financial crisis inand smaller events like the earthquake in Japan. While this has been good for some investors, it has also make others very nervous. And that instability could be very costly for some volatility investors. Investors bet on volatility in order to make money when the market is volatile.

Long/Short

With access to market data 24 hours a day, 6 days a week, Interactive Brokers services markets, 31 countries, and 23 currencies using one account login. Many professional investors, hedge fund managers, individual traders and speculators use the VIX to measure market risk ahead of taking action in the stock market. If you have an interest in trading VIX options, keep in mind that how you trade VIX options is just as important as where you trade, so make sure you pick the right options broker for your needs. Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people. Furthermore, historical volatility, which is also called known or statistical volatility , can be measured objectively for a given past timeframe. This is done by computing the standard deviation of price changes observed on some basis say from close to close and then annualizing the result. Most importantly for VIX option traders, implied volatility is the level of volatility for a particular future time frame. This is implied by option prices for that same time frame using an options pricing model, like the Black Scholes model. Options are contracts with an expiration date and a value determined by the price of an underlying asset.

How to Read a Forex Quote

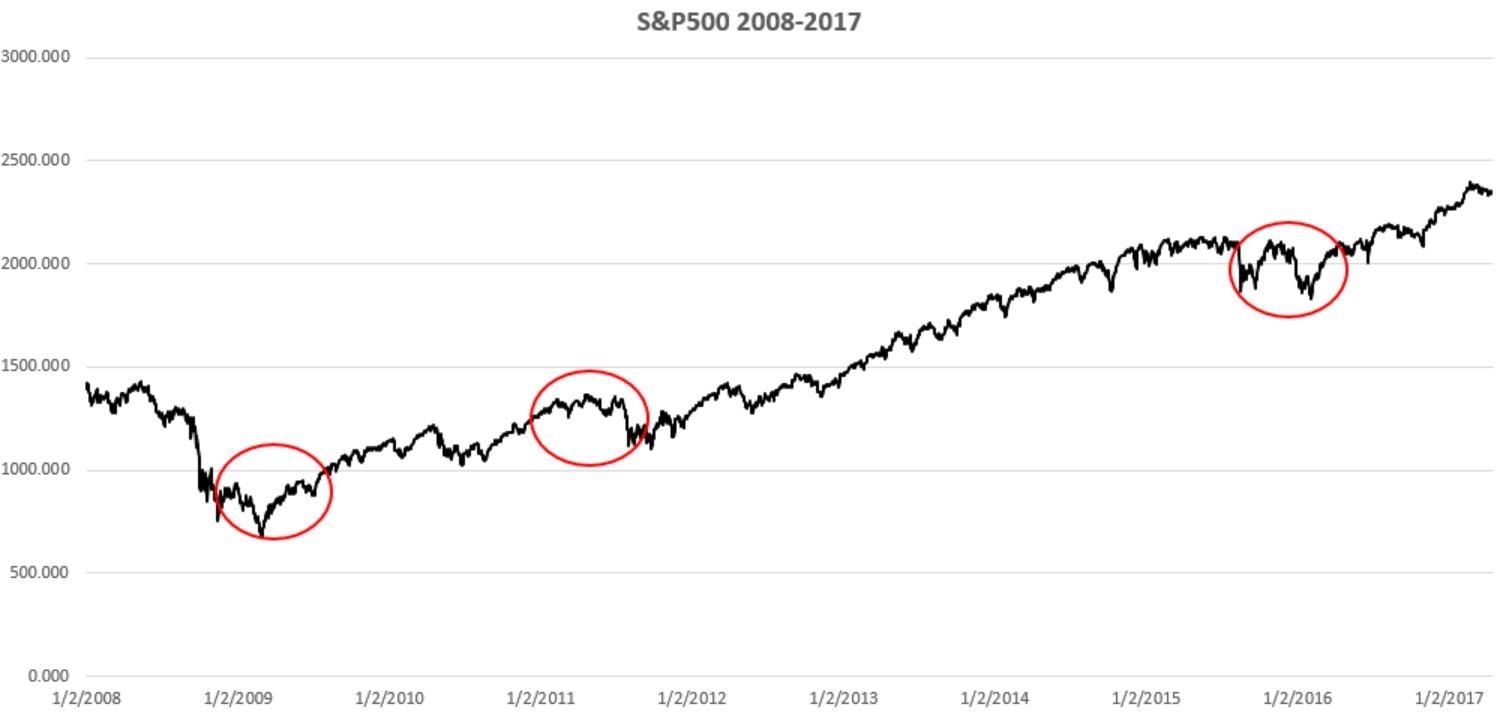

Positions in the underlying VIX futures contracts are always offset before the delivery date or offset in cash on the delivery date since there can be no delivery of the index. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. Getting a good handle on the underlying index before trading options on the index also makes perfect sense. Like virtually any market, the VIX Index can be analyzed using technical analysis. It will therefore typically rise to reflect a higher level of fearful emotions and a growing state of uncertainty in the market and it will decline to signal a reduction in the level of those risk-related factors. A good way to get familiar with how the index trades is to watch it during periods of market uncertainty. Do this during a major stock market selloff, as shown in the image below, or after the release of a significant economic number. Once you have an idea of how the index reacts to moves in the underlying market, you can then consider what option strategy you might apply. Options trading strategies vary and can be implemented for up markets, down markets and sideways markets. For example, consolidating markets tend to depress implied volatility, while sharply moving markets tend to boost it. These are important upcoming economic releases or anticipated major events, such as elections or referendums, which might take place over the duration of the options you trade. Beginners might want to stick to simple call and put buying to take advantage of directional moves in the VIX Index.

How do you bet on volatility?

More often than not, they turn quite bullish when they think a stock is headed higher and quite bearish when they fear that all is lost. The trouble with this strategy is that, for most retail investors, it is exactly at these extremes in sentiment when they lose their shirts While conventional financial theory does suggest the idea that markets behave rationally, not accounting for the emotional aspect of the trade, this often leads to all of the wrong entry and exit points. And believe me when I tell you this: It’s hard to make any money on the Street when you’re constantly getting either one or both of them wrong. That’s why successful technical analysts often rely on the VIX indicator to assess whether or not the current market sentiment is either excessively bullish or bearish in order to plot their next move.

Not Helpful 5 Helpful Indices Votes: 43 Remember the cardinal rule in stock trading is to buy low and sell high. Is there any charge for trading? If your stock value has increased significantly, you may want to evaluate whether you should sell the stock and reinvest the profits in other lower priced stocks. ChowClown Senior member 2, If you feel like you’re losing control of your ability to make rational choices about investing your money, try to find help before you lose everything. Reactions: richardkangning , wolf , MaxiV and 9 others. Consider investing in mutual funds. LL Linda Leo Dec 6, It can be applied on any timeframe but I use it to make money on the hourly and daily timeframe because this is what I am comfortable with. Article Summary X While stock trading can be risky, you might be able to make a lot of money if you do your research and invest in the right companies. The above article offers lots of good tips. However, those stocks tend to be stable, which means you have a lower chance of losing money.

What to Read Next

A stockholder does not actually gain or lose money until he or she sells the stock they hold. After all, how many businesses can you «try» first without losing any money? Remember the cardinal rule in stock trading is to buy low and sell high. Making more money from mid term trades Started by Steakeater Apr 30, Replies: 3. This is simply because I have heard many traders complain that although they could make money consistently on demo it all fell apart when the account went live. Not Helpful 0 Helpful 6. One trasing that the «demo affect» shows itself is that positions can become much harder to hold when you are live, the money actually means something and you are fearful of giving too much of it back to the market. Sourabh Gupta Apr 18, Monitor the markets daily.

The Evolution of the VIX

Stock trading is not a risk-free activity, and some losses are inevitable. However, with substantial research and investments in the right companiesstock trading can potentially be very profitable. While stock trading can be risky, you might be able to make a lot of money if you do your research and invest in the right companies. Start by researching current market trends from trustworthy publications, like Kiplinger, Bloomberg BusinessWeek, and the Economist.

Then, decide which trading sites you’d like to use, and make an account on 1 or more of the sites. If you can, practice trading before you put any real money in the market by using market simulators. When you’re ready to trade, choose a mixture of reliable mid-cap and large-cap stocks, and monitor the markets daily. For tips from our financial reviewer on buying and selling stocks for profit, read on!

This article was co-authored by Michael R. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. Categories: Making Money Online.

Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy. Article Edit. Learn why people trust wikiHow. Co-authored by Michael R. Lewis Updated: September 3, There are 22 references cited in this article, which can be found at the bottom of the page. Research current trends. There are many reputable sources that report on market trends.

Select a trading website. Be sure that you are aware of any transaction fees or percentages that will be charged before you decide on a site to use. You might want to read reviews of the business online. Create an account with one or more trading websites. Be sure to check out the minimum balance requirements for each site. Your budget may only allow you to create accounts on one or two sites. Practice trading before you put real money in. Some websites such as ScottradeELITE, SureTrader, and OptionsHouse offer a virtual trading platform, where you can experiment for a while to assess your instincts without putting actual money in.

In real trading, there will be a delay when buying and selling stocks, which may result in different prices than you were aiming. Additionally, trading with virtual money will not prepare you for the stress of trading with your real money. Choose reliable stocks. You have a lot of choices, but ultimately you want to buy stock from companies that dominate their niche, offer something that people consistently want, have a recognizable brand, and have a good business model and a long history of success.

A more profitable company usually means a more profitable stock. You can find complete financial information about any publicly traded company by visiting their website and locating their most recent annual report.

If it is not on the site you can call the company and request a hard copy. Analyze their balance sheet and income statement and determine if they are profitable or have a good chance to be in the future. If all technology stocks were down at one point, evaluating them relative to each other rather than to the entire market can tell you which company has been on top of its industry consistently.

First, analyze the company’s quarterly earnings release that is posted online as a press release about an hour before the. Buy your first stocks.

When you are ready, take the plunge and buy a small number of reliable stocks. The exact number will depend on your budget, but shoot for at least two.

Begin trading small and use an amount of cash you are prepared to lose. You just have to be careful to avoid large transaction fees, as these can easily eat up your gains when you have a small account balance. Invest mostly in mid-cap and large-cap companies. Monitor the markets daily. Remember the cardinal rule in stock trading is to buy low and sell high.

If your stock value has increased significantly, you may want to evaluate whether you should sell how to make money trading the vix stock and reinvest the profits in other lower priced stocks.

Consider investing in mutual funds. Mutual funds are actively managed by a professional fund manager and include a combination of stocks. These will be diversified with investments in such sectors as technology, retail, financial, energy or foreign companies.

Buy low. This means that when stocks are at a relatively low price based on past history, you buy. To determine if a stock is undervalued, look at the company’s earnings per share as well as purchasing activity by company employees. Look for companies in particular industries and markets where there’s lots of volatility, as that’s where you can make a lot of money. Sell high. You want to sell your stocks at their peak based on past history. If you sell the stocks for more money than you bought them for, you make money.

The bigger the increase from when you bought them to when you sold them, the more money you make. Do not sell in a panic. When a stock you have drops lower than the price you bought it for, your instinct may be to get rid of it. While there is a possibility that it can keep falling and never come back up, you should consider the possibility that it may rebound.

Study the fundamental and technical market analysis methods. These are the two basic models of understanding the stock market and anticipating price changes. The model you use will determine how you make decisions about what stocks to buy and when to buy and sell.

This analysis seeks to give an actual value to the company and, by extension, the stock. A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. This involves looking at trends and analyzing investor reactions to events. Consider investing in companies that pay dividends.

Some investors, known as income investors, prefer to invest almost entirely in dividend-paying stocks. This is a way that your stock holdings can make money even if they don’t appreciate the price.

Dividends are company profits paid directly to stockholders quarterly. Diversify your holdings. Once you have established some stock holdings, and you have a handle on how the buying and selling works, you should diversify your stock portfolio. This means that you should put your money in a variety of different stocks. Start-up companies might be a good choice after you have a base of older-company stock established.

If a startup is bought by a bigger company, you could potentially make a lot of money very quickly. If your original holdings are mostly in technology companies, try looking into manufacturing or retail. This will diversify your portfolio against negative industry trends. Reinvest your money. When you sell your stock hopefully for a lot more than you bought it foryou should roll your money and profits into buying new stocks.

Consider putting a portion of your profits into a savings or retirement account. Invest in an IPO initial public offering. An IPO is the first time a company issues stock. Take calculated risks when selecting stocks. The only way to make a lot of money in the stock market is to take risks and get a little bit lucky. This does not mean you should stake everything on risky investments and hope for the best. Investing should not be played the same way as gambling.

You should research every investment thoroughly and be sure that you can recover financially if your trade goes poorly. On one hand, playing it safe with only established stocks will not normally allow you to «beat the market» and gain very high returns. However, those stocks tend to be stable, which means you have a lower chance of losing money.

And with steady dividend payments and accounting for risk, these companies can end up being a much better investment than riskier companies. You can also reduce your risk by hedging against losses on your investments.

Trading VIX Options: Top 3 Things to Know — Volatility Trading

Why Zacks? Learn to Be a Better Investor. Forgot Password. When the VIX rises, it’s expected that volatility will rise and stock market prices will fluctuate more quickly and sharply.

Perhaps don’t try this in 2018

The VIX is a measurement of the U. Call options allow someone to buy a stock or another asset at a certain price, called the strike rtading, at a certain time. Put options allow you to sell the stock or asset at the strike price at a certain time. Call options, which take their name from calling for delivery of the asset, go up in value when it’s more likely or expected that the asset price will exceed the strike price, since they’ll let you buy the stock at a bargain price. Conversely, put options go up in value when it’s more likely that the asset price will be less than the vic price, since whoever holds the options will be able to sell the asset for more than it’s otherwise worth. The measurement is sometimes popularly known as Wall Street’s Fear Gaugesince it rises when people expect a bumpy change in stock prices that can make investing difficult rather than a smooth rise, decline or plateauing of prices. It’s not technically correct to say that the VIX ever how to make money trading the vix an initial public offeringsince it’s not a stock that went through an IPO processbut the index did make its formal viz in That tading tracks the performance t major U.

Comments

Post a Comment