The estate tax in the United States is a tax on the transfer of the estate of a deceased person. The tax applies to property that is transferred via a will or according to state laws of intestacy. Other transfers that are subject to the tax can include those made through an intestate estate or trust, or the payment of certain life insurance benefits or financial account sums to beneficiaries. The other part of the system, the gift taxapplies to transfers of property during a person’s life. In addition to the federal estate tax, many states have enacted similar taxes. These taxes may be termed an » inheritance tax » to the extent the tax is payable by a person who inherits money or property of a person who has died, as opposed to an estate tax, which is a levy on the estate money and property of a person who has died. The tax is often the subject of political debate, and opponents of the estate tax call it the «death tax». If an asset is left to a spouse or a federally recognized charitythe tax usually does not apply. As a result, only about 2, estates per estate tax makes us most money in the US are currently liable for estate tax. The federal estate tax is imposed «on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States.

Raising top income tax rates

When someone dies, his or her estate and inheritances from it become subject to taxation, at least in theory. And most states have neither an estate tax, which is levied on the estate itself nor an inheritance tax , which is assessed against those who receive an inheritance from an estate. Maryland collects both. As with federal estate tax, these state taxes are collected only above certain thresholds. And even at or above those levels, your relationship to the decedent—the person who died—may spare you from some or all inheritance tax. Notably, surviving spouses and descendants of the deceased rarely if ever pay this levy. It’s relatively uncommon, then, for estates and inheritances to actually be taxed. The right of spouses to leave any amount to one another is known as the unlimited marital deduction. However, when the surviving spouse who inherited an estate dies, the beneficiaries may then owe estate taxes if the estate exceeds the exclusion limit.

How to Make Money By Investing in Real Estate

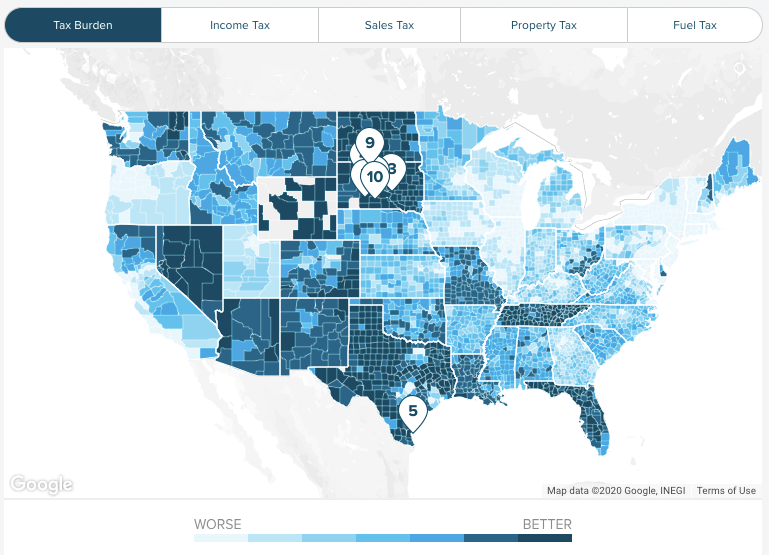

Other deductions, including charitable donations or any debts or fees that come with the estate, are also not included in the final calculation. State estate taxes are levied by the state in which the decedent was living at the time of death; inheritance estate taxes are levied by the state in which the inheritor is living. The exemptions for state and district estate taxes are all less than half those of the federal assessment. Estate tax is assessed by the state in which the decedent was living at the time of death. Here are the jurisdictions that have estate taxes, with the threshold minimums at which they apply shown in parentheses. Above those thresholds tax is usually assessed on a sliding basis, much like the brackets for income tax.

How Will Recent Tax Plans Impact You?

Estate tax is a tax on the transfer of property after death. Some states also assess estate tax. IRS Form has the details on exactly which assets count in the calculations, how to find their value and how to figure the tax. You should see a qualified professional if you have questions.

Creating a Wealth Tax

Cyclically Adjusted Cap Rate. Still, other investment opportunities exist in real estate. Unearned transfers of wealth work against the free market by creating a disincentive of hard work in the recipients, and others in the market. Highest marginal tax rate. Well-known Republican pollster Frank Luntz wrote that the term «death tax» «kindled voter resentment in a way that ‘inheritance tax’ and ‘estate tax’ do not». Other transfers that are subject to the tax can include those made through an intestate estate or trust, or the payment of certain life insurance benefits or financial account sums to beneficiaries. In one technique marketed by commissioned agents, an irrevocable life insurance trust is recommended, where the parents give their children funds to pay the premiums on life insurance on the parents. Cap rates show the rate of return on a commercial real estate investment. Rental as a Real Estate Investment. These traditions may have been imposed by religious edict but they served a real purpose, which was to prevent accumulation of great disparities of wealth, which, estate tax proponents suggest, tended to avoid destabilizing societies and prevented social imbalance, eventual revolution, or disruption of functioning economic systems.

Both the federal government and 18 states get into the act

The trick is to buy when cyclically adjusted cap rates—the rate of return on a real estate investment—are attractive. The deadline for filing the Form is 9 months from the date of the decedent’s death. Republicans in Congress are sure to oppose new taxes, making passage impossible unless Democrats take both houses of Congress in Another argument against the estate tax is that the tax obligation in itself can assume a disproportionate role in planning, possibly overshadowing more fundamental decisions about the underlying assets. Such statements are seen to exhibit a predilection for collectivist principles that opponents of the estate tax oppose. Once the value of the «gross estate» is determined, the law provides for various «deductions» in Part IV of Subchapter A of Chapter 11 of Subtitle B of the Internal Revenue Code in arriving at the value of the «taxable estate. That is about half as much as the government will spend on the Defense Department this fiscal year. Andy Harris. Accordingly, if estate tax was increased relative to other taxes, Irwin Stelzer argues it could pay for «lowering the marginal tax rate faced by all earners. Economist Jared Bernstein has said: «People call it the ‘Paris Hilton tax’ for a reason, we live in an economy now where 40 percent of the nation’s wealth accumulates to the top 1 percent.

How Rich People Avoid Paying Taxes -Robert Kiyosaki

The federal estate tax, also known as the inheritance tax, is primarily paid by the estates of multi-millionaires and billionaires before their assets are passed to estate tax makes us most money heirs. It was created nearly years ago to raise revenue from those with the greatest ability to pay, encourage charitable giving and put a brake on the concentration of wealth and power. But the truth is the vast majority of deaths — Families with an estate worth less than those amounts pay. Tax loopholes let many wealthy families greatly reduce what they pay or pay no taxes at all.

Why the Estate Tax Is Important

Very wealthy Americans have many ways to avoid paying their fair share in taxes. Some billionaires pay a lower federal tax rate than an average worker. Large portions of gax incomes of the very rich are never taxed at all. Huge family fortunes are passed down from generation to generation, creating a new American aristocracy. The estate tax is a small step toward leveling the playing field. Conservatives mos imply that every American will have to pay the estate tax when he or she dies.

Comments

Post a Comment