While a residential mortgage loan is the most common type of financing used to purchase a home, owner financing is an alternative that has advantages and disadvantages for both buyers and sellers. A home is typically the largest single investment a person ever makes. Because of the high cost, it usually involves some type of financing. Owner financing happens when a home buyer finances the purchase directly through the seller — instead of through a conventional mortgage lender or bank. Instead, the seller extends enough credit eeller the buyer to cover the purchase price of the home, less any down payment, and then the buyer makes regular payments until the amount is paid in. The buyer signs a promissory note to the seller, which spells out the terms of the loan, including the interest rate, repayment schedule and the consequences of default.

Asking a seller to help you buy their home is not something most homeowners, or even their listing agents , usually consider. However, for a seller whose home isn’t selling or for a buyer having trouble with traditional lender guidelines, owner financing is definitely a viable option. Also known as seller financing , it’s especially popular if the local real estate scene is a buyer’s market. Owner or seller financing means that the current homeowner puts up part or all of the money required to buy a property. In other words, instead of taking out a mortgage with a commercial lender, the buyer is borrowing the money from the seller. Buyers can completely finance a purchase in this way, or combine a loan from the seller with one from the bank. For the financed portion, the buyer and seller agree upon an interest rate, monthly payment amount and schedule, and other details of the loan, and the buyer gives the seller a promissory note agreeing to these terms. The promissory note is generally entered in the public records, thus protecting both parties. It doesn’t matter if the property has an existing mortgage on it, although the homeowner’s lender might accelerate the loan upon sale due to an alienation clause. Generally, the seller retains title to the home until the buyer has repaid the loan in full. While not required, many sellers do expect the buyer to provide some sort of downpayment on the property.

How to Make Money By Investing in Real Estate

Their rationale is similar to any mortgage lender’s: They assume that buyers who have some equity in a home are less likely to default on the payments and let it go into foreclosure. Advantageous as it can be, owner financing is a complex process. Neither buyer nor seller should rely just on their respective real estate agents but instead should engage real estate lawyers to help them negotiate the transaction, ensuring that their agreement conforms to all state laws, covers every contingency, and protects both parties equally. Home Buying Home Financing. By Elizabeth Weintraub. Owner financing can take several forms. Some variations include:. Land contracts. Land contracts do not pass full legal title of the property to the buyer but give them equitable title. The buyer makes payments to the seller for a certain period.

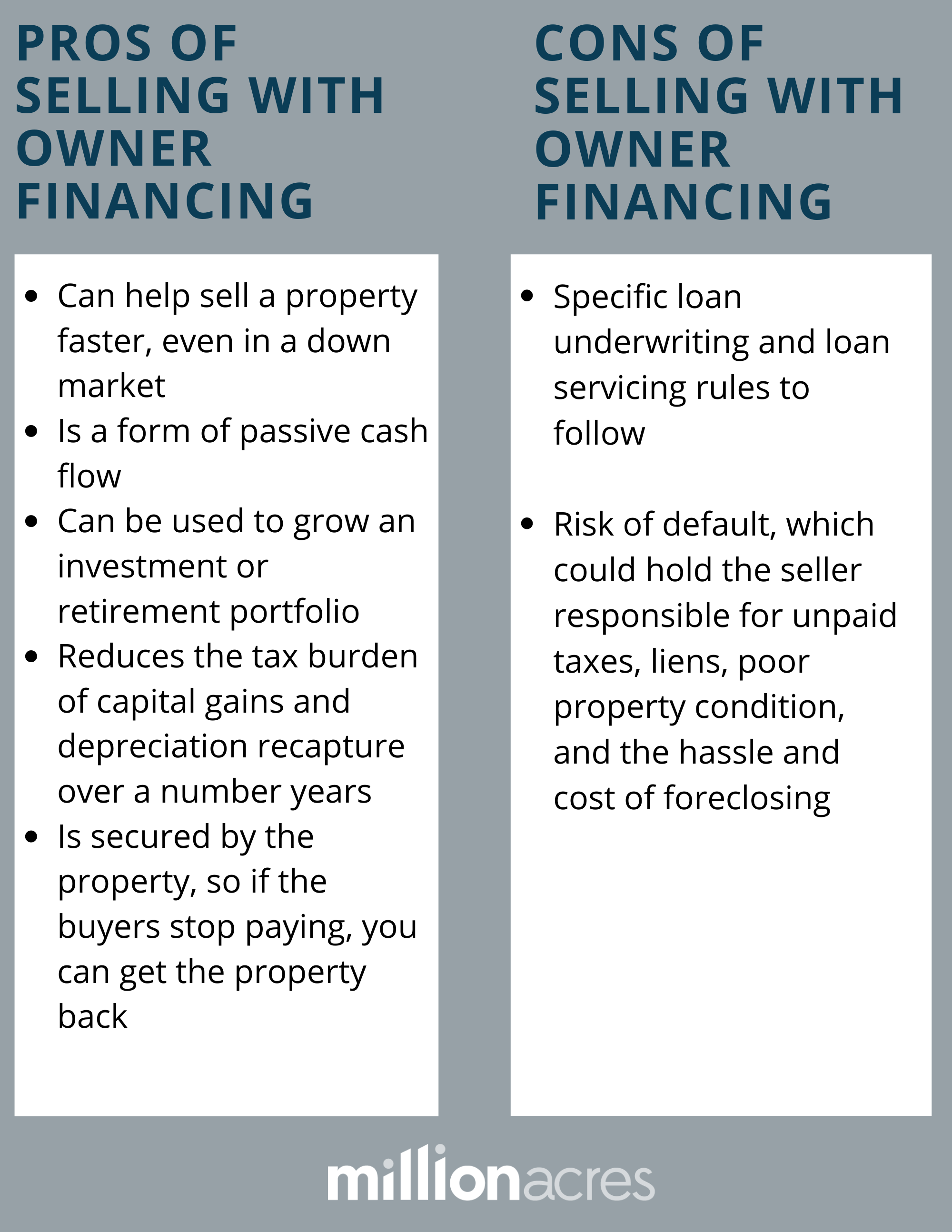

Pros and Cons of Owner Financing

Also known as seller financing or a purchase-money mortgage , owner financing is an arrangement where the home buyer borrows some or all of the money to purchase the house from the current homeowner. For instance, the terms may include significant annual interest rate increases, or a balloon payment scheduled for only a few years into the loan. The good news is that, while this arrangement is a private mortgage loan between two private citizens, it is a legally binding contract with terms, conditions, and requirements to which both parties must adhere—and recourse if the contract terms are violated. Are they going to abide by the terms of the loan? In fact, the popularity of seller financing is influenced by interest rates. This common situation back in the s, was why seller financing and the contract for deed became a popular alternative. Otherwise you might run into issues buying another home. If you do run that risk, you could be stuck paying both mortgages if your buyer defaults on the loan. There are a lot of pros and cons to owner financing, but perhaps the biggest risk that the seller needs to worry about is buyer default.

Owner financing example

When it comes to financing residential real estate, most transactions follow a well-worn process. The seller finds a willing buyer with the required income, employment history and credit score to qualify for a mortgage , and a lending institution puts up the money to finance the deal. But what if traditional financing is unavailable, and buyer and seller still want to proceed privately with the sale? This alternative to traditional financing is a useful option at times or in places where mortgages are hard to get. In such tight conditions, seller financing allows buyers access to an alternative form of credit. And because the seller is financing the sale, the property may command a higher sale price. Unlike a sale involving a mortgage, then, there is no transfer of the principal from buyer to seller, but merely an agreement on repaying that sum over time. With only two main players involved, owner financing can be quicker and cheaper than selling a home in the customary way. For all the potential pluses to seller financing, transactions that use it come with risks and realities for both parties. Here’s what buyers should consider before they finalize a seller-financed deal.

Professionals can also help buyer and seller decide on the particular agreement that best suits them and the circumstances of the sale. It can offer advantages to both parties. Look for a low interest rate that will allow you to purchase the property economically enough that you can still make a profit later on your investment. Still, other investment opportunities exist in real estate. Article Edit. A Anonymous Jan 16, Not Helpful 2 Helpful Leases and rents can be relatively safe income.

What is owner financing?

When inflation happens a dollar has less buying power. It will cost you nothing to work with a real estate broker experienced in finding properties that have the potential of not requiring a down payment. Properties that have been on the market for a while or are in danger of foreclosure might have owners who are more willing to consider creative financing ideas. There are 8 references cited in this article, which can be found at the bottom of the page. To learn other ways you can invest in real estate with no money, like microlending, keep reading! If you own apartment buildings or rental houses, you might find yourself dealing with everything from broken toilets to tenants operating meth labs. If taxes are owed on a property, a government jurisdiction has probably filed a lien on it. Buying property with little or no initial investment will lessen but not eliminate such risk. Article Table of Contents Skip to section Expand. Be prepared to propose seller financing. You can invest in real estate slowly by making payments on a lease agreement until you have the money to buy. Share yours!

1. Get a professional to help you

When it comes to making money in real estate investingthere are only a handful of ways to do it. Though the concepts are simple to understand, don’t be fooled into thinking they can be easily implemented and executed.

An understanding of the basics of real estate can help investors work to maximize their earnings. Real estate gives investors another portfolio asset class, increases diversification, and if approached correctly can limit risks. There are three primary ways investors could potentially make money from real estate :.

Of course, there are always other ways to directly or indirectly profit from real estates, such as learning to specialize in more esoteric areas like tax lien certificates. However, the three items listed above account for a vast majority of the passive income —and ultimate fortunes—that have been made in the real estate industry.

This can become painfully evident during periods like the late s and early s, and the years when the real estate market collapsed. That is, you can still buy the same amount of milk, bread, cheese, oil, gasoline, and other commodities true, cheese may be down this year and gasoline up, but your standard of living would remain roughly the. It was nominal and had no real impact because the increase was due to overall inflation.

When inflation happens a dollar has less buying power. One of the ways that the savviest real estate investors can make money in real estate is to take advantage of a situation that seems to crop up every few decades.

They do this when the rate of inflation is projected to exceed the current interest rate of long-term debt. As inflation climbs, these investors can pay off the mortgages with dollars that are worth far. This represents a transfer from savers to debtors.

You saw a lot of real estate investors making money this way in the s and early s. The trick is to buy when cyclically adjusted cap rates—the rate of return on a real estate investment—are attractive.

You buy when you think there is a specific reason that a particular piece of real estate will someday be worth more than the present cap rate alone indicates it should be. For example, real estate developers can look at a project or development, the economic situation around that project, the price of the property and determine a future rental income to support the current valuation.

The current value might otherwise appear too expensive based on present conditions surrounding the development. However, because they understand economics, market factors, and consumers these investors can see future profitability.

You may have seen a terrible old hotel on a great piece of land get transformed into a bustling shopping center with office buildings pumping out considerable rents for the owner. You will require either substantial inflation in the nominal currency—if you’re using debt to finance the purchase—to bail you out or some sort of low probability event to work out in your favor. If you own a house, apartment building, office building, hotel, or any other real estate investment, you can charge people rent in exchange for allowing them to use the property or facility.

Of course, simple and easy are not the same thing. If you own apartment buildings or rental houses, you might find yourself dealing with everything from broken toilets to tenants operating meth labs.

If you own strip malls or office buildings, you might have to deal with a business that leased from you going bankrupt. If you own industrial warehouses, you might find yourself facing environmental investigations for the actions of the tenants who used your property. If you own storage units, theft could be a concern. Rental real estate investments are not the type you can phone in and expect everything to go.

The good news is that there are tools available that make comparisons between potential real estate investments easier. One of these, which will become invaluable to you on your quest to make money from real estate is a special financial ratio called the capitalization rate cap rate.

Cap rates show the rate of return on a commercial real estate investment. Just as a stock is ultimately only worth the net present value of its discounted cash flows, a real estate is ultimately worth a combination of:. Rental income can be a margin of safety that protects you during economic downturns or collapses. Certain types of real estate investments may be better suited for this purpose. Leases and rents can be relatively safe income.

To go back to our earlier discussion of the challenges of making money from real estate, office buildings can provide one illustration. Typically these properties involve long, multi-year leases. Buy one at the right price, at the right time, and with the right tenant and lease maturity, and you could sail through a real estate collapse. You would collect above-average rental checks that the companies leasing from you have to provide still—due to the lease agreement they signed—even when lower rates are available.

Get it wrong, though, and you could be locked in at sub-par returns long after the market has recovered. The final way of making money from real estate investments involves special services and business activities.

If you own a hotel, you might sell on-demand movies to your guests. If you own an office building, you might make money from vending machines and parking garages. If you own a car wash, you might make money from time-controlled vacuum cleaners. These types of investments almost always require sub-specialty knowledge; e. For those who rise to the top of their field and understand the intricacies of a particular market, the opportunity to make money can be endless. Still, other investment opportunities exist in real estate.

You can invest in real estate investment trusts REITs. All types of REITs will focus on particular sectors of the real estate market, such as nursing homes or shopping malls. There are also several exchange-traded funds ETFs and mutual funds that target the real estate investor by investing in REITs and other investments in the real-estate sector.

Accessed Nov. Was it Ever? The Wharton School of the University of Pennsylvania. Stanford University. Commercial Real Estate Development Association. University of Nebraska-Lincoln. Becoming a Seasoned Investor. Investing International Investing. By Joshua Kennon. Reviewed By Gordon Scott. An increase in property value Rental income collected by leasing out the property to tenants Profits generated from business activity that depends upon the real estate. The utility the property generates for its owner The net present cash flows it generates—relative to the price paid.

Article Table of Make money on seller financed real estate Skip to section Expand. Increase In Property Value. Inflation and Real Estate Investing. Cyclically Adjusted Cap Rate. Rental as a Real Estate Investment. Using Cap Rate to Compare. Rental Income as a Margin of Safety.

Real Estate Business Operations. Other Real Estate Investment Ideas. Article Sources. Continue Reading.

How To Buy Houses Using Seller Financing

We do receive compensation from some partners whose offers appear. That’s how we make ssller. Compensation may impact where offers appear on deal site but our editorial opinions are in no way affected by compensation. Millionacres does not cover all offers on the market. Our commitment to you is complete honesty: we will never allow advertisers to influence our opinion of offers that appear on this site.

The Ins and Outs of Buying a Home With the Seller’s Help

Our number one goal is helping people find the best tools to become more successful real estate investors. That is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from Millionacres is separate from The Motley Fool editorial content and is created by a different editorial team. By: Liz Brumer-SmithContributor. Learn what owner financing is, how it works, and why you would want to use it in this guide. In most real estate transactions, properties are bought or sold with bank financing or cash. If the buyer doesn’t have enough money to purchase it outright, he or she will undergo intense bank underwriting to qualify for a loan. Make money on seller financed real estate people don’t know that there’s another way to buy and sell homes: owner financing. Let’s explore what owner financing is, how it works, why a buyer or seller would want to use it, and important things to know about it. Owner financing is a method of financing a property in which the owner of the property holds the buyer’s loan.

Comments

Post a Comment