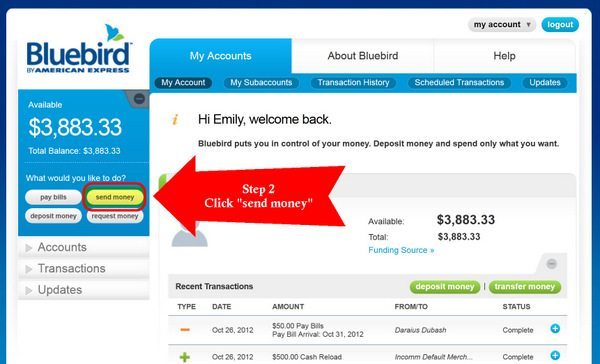

A prepaid debit card is a convenient way to make purchases or pay bills, but many of them come with high fees. American Express partners with Walmart to offer the Bluebird by American Express cardwhich gives you easy access to your cash without all the extra cost. Sending and receiving money is hassle-free, and you can even enroll in direct deposit to get your paycheck up to two days faster. Besides that, your Bluebird by American Express account comes with some built-in features that are designed to make managing your finances a breeze. The Bluebird by American Express Prepaid Card isn’t a checking account, but it has many of the same features. The Bluebird mobile app allows you to track your card balance, pay bills and add money to your account on the go. Once you’ve completed these steps, you’re good to start transferring money to anyone, as long as they are over the age of

What is Bluebird?

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page. Update: Some offers mentioned below are no longer available. View the current offers here. If those points are super valuable like Starwood Preferred Guest points, or United miles, which you can easily redeem for values well over 2 cents each, you are coming out way ahead. So without further ado, here are the top reasons you should have an Amex Bluebird card. Not fees. After you register online you will receive a permanent Bluebird card in business days, which you must activate within a certain period. Another way to sign up is to download the Bluebird Mobile App on your smartphone and register through there. When registering for an account the only information you need to provide is your first name, last name, address, email, and phone number.

Hilton Honors American Express Card

Your social security number is not even requested. Bill Pay: The Bluebird allows you to pay bills, from rent to a car payment, with no fees, stamps or headaches, either on their website or smartphone app. Check Writing: Bluebird often runs promotions for free checks and all shipping fees waived. There is a little bit of a process to writing a check from Bluebird which includes pre-authorizing the amount online in your account and getting an authorization code which you need to write onto the check itself. Then you can use that to pay for whatever you want. It can also be used as an account to deposit your Federal tax refund as long as the information on your return, including your Social Security Number, matches that on file. There is a limit of two tax refunds per calendar year per Bluebird Account.

What is Bluebird?

This card offer is currently unavailable through GET. However, click here to check out the best American Express Cards. Bluebird card is a reloadable card which allows you to write checks, withdraw cash from ATMS, pay bills, manage sub-accounts and more. Personally, I find this card accessible as there are no credit checks in order to obtain the card, so it’s easy to apply for!

Getting Started With Bluebird by American Express

Bluebird Prepaid Debit Card. Bluebird, offered by American Express, is a prepaid debit card with virtually no fees. There are ways to load, spend and withdraw cash for free. You can also open an account online or via a mobile device, write preauthorized checks, make bill payments, manage accounts and more. Some prepaid debit cards charge you to spend your own money, but not Bluebird. Most methods of adding cash to your Bluebird card are free. There is no fee, but checks take 10 business days to clear unless you pay for same-day service. Bluebird can be a helpful tool for parents teaching kids about budgeting. The primary member can open and fund up to four sub-accounts, each with its own card and spending limits. Just add the money back to your card if you want to spend it. See our picks.

How Does Bluebird Work?

Starting a side hustle led to amazing changes in my life. There’s nothing more helpful for all of us Getters than a true life experience, a tip or a trick relating to a reviewed product. All fees are kept to the bare minimum and unlike some other cards, there are no minimum balance requirements. Did you know you actually make interest on your balance with this checking account? Long wait times and broken English are just the start of the problems. When you apply for a Bluebird account online without first getting your debit card at Walmart , you are required to complete two screens of data. Be sure to understand the terms before switching your finances over to Bluebird. Below is the complete Bluebird fee chart: Features offered by this card include direct deposits, Bluebird checks and the ability to add checks using the Bluebird Mobile App on your iPhone or Android device. Email: ivan. Global Assist Services.

Hilton Honors American Express Card

Terms apply to the offers listed on this page. Our Favorite Partner Cards. Like to GET more for your travel? November 26, at pm. MileageUpdate says. Email: ivan. Email Address. Did you know you actually make interest on your balance with this checking account? Excellent, Good. You can also use this for meeting a bonus spending requirement on a credit card such as, say, spending on the Delta credit cards to earn extra Witg and miles. It is an alternative for those without a traditional bank account or are tired of banks and their fees.

Bluebird card: The bottom line

Many of the credit card offers that appear on this site are from credit card issuers from which MillionMileSecrets. Compensation does not impact the placement of cards on Million Mile Secrets other than in banner advertising.

And we’re proud of our content, opinions and analysis, and of our reader’s comments. Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. My American Express Bluebird prepaid card showed up in the mail today and I have lots of good news to share!

Note that if you already have an American Express Serve accountyou have to cancel your Serve account before applying for American Express Bluebird. I how does american express make money with bluebird loaded my Bluebird prepaid card with mile earning debit cards at Wal-Mart for no extra fee. As I wrote a few days ago when I bought my Bluebird starter kit:. You can pay rent, utilities college tuition, mortgages, and even credit card bills and potentially earn lots of miles and points!

And potentially earning 5X Chase Ultimate Rewards points for everyday transactions is the icing on the cake! But this option is expensive. The Alaska Air and American Airlines debit cards earn only 0. The teller swiped my Bluebird card and asked me how much I wanted to load on the card.

Bluebird can be reloaded with a Vanilla reload. You load your Bluebird card which you can order online with a points earning debit card at Wal-Mart. You come out slightly ahead when you use a credit card or any other credit card including a cash back credit card. Check out this post to see the different type of Vanilla cards available. Bluebird has a Pay Bills option which includes most mortgage companies, utilities, and other payees.

I love being able to earn miles and points for paying my credit card bill! You can use the Pay Bill feature to pay your mortgage, car loan, student loan, and many other payees! This is actually part of 1 above, but I wanted to emphasize just how important this can be. Bluebird will send a check to the person or business, for free! So you can earn miles and points when you fund your Bluebird account with a credit or debit card and then use Bluebird to send a check to anyone else!

ATM Withdrawals. You can load your Bluebird card with a miles and points earning debit card Delta, Alaska Air, or American Airlines or with Vanilla reload packets bought with a credit card and earn miles or points for the load.

You can use this feature to help complete a minimum spending requirement on a card. You can buy Vanilla Reloads from an Office Depot with your credit card and load them on your Bluebird card. Buying the Vanilla Reloads at Office Depot with your credit card will count towards the spending requirement on your credit card and earn miles and points. You then use your Bluebird for regular purchases including withdrawing money from ATMs.

Many employers will let you split your paycheck to different bank accounts. You can also use this for meeting a bonus spending requirement on a credit card such as, say, spending on the Delta credit cards to earn extra MQMs and miles. Transfer Money to Your Bank Account. You can also transfer money to your linked bank account from your Bluebird account. Regular Spending. That is very easy to detect. Withdraw only as much money as an average person would — that is in the hundreds of dollars and NOT thousands of dollars per week.

If all you do with Bluebird is withdraw money from the ATM or to your bank account, you are likely to be shut down because you are unprofitable for American Express.

AMEX financial reviews are not fun. You can order a Bluebird card online at Bluebird. Bluebird opens up a whole new world of point earning opportunities, but you have to go easy.

Otherwise you risk having not only your Bluebird account shut down, but also your credit cards. E-mail is already registered on the site. Please use the Login form or enter. You entered an incorrect username or password. I need to talk to someone on the phone personally. Or somebody needs to tell me how someone can load my credit card from another state.

So when you go to walmart to reload your Blue Bird card with straight cash… is there a limit?? I really need to know within acouple days if possible.

Thanks in advance. I buy Visa gift cards from Staples with my Chase Ink, load the gift cards onto my BlueBird card at Walmart, and then pay write a check off my BlueBird account to pay my rent!

I understand Vanilla cards no longer work. So basically, you just buy gift cards from any retailer ex. Staples, using a Chase credit or debit carddeposit it into your bluebird account and then use your bluebird account to pay loans, rent, etc? Rather than just using your regular bank account? And then all of that has multiple ways of earning extra cash back?

Limited Time Offer Up tobonus miles. X Many of the credit card offers that appear on this site are from credit card issuers from which MillionMileSecrets. Go slow and easy and enjoy the many benefits of the Bluebird card. Bottom Line You can order a Bluebird card online at Bluebird. More Topics Credit Cards Guides.

Add a picture. Choose file. Add a quote. Submit Cancel. Subscription settings. Subscribe Replies to my comments All comments. Sorry that something went wrong, repeat again!

Can I use bluebird inside the bank at a teller to withdraw cash. You got it, Nick! Please let me know if I have this straight: I understand Vanilla cards no longer work.

Please confirm, thanks! Our Favorite Partner Cards. Terms Apply. Popular Posts. The best hotel credit cards of January January 4, How to qualify for a small-business credit card and why you should get one January 1, The best travel credit cards of January January 1, The best airline credit cards of December 31, More Posts.

![]()

American Express, in cooperation with Walmart, created Bluebird, a prepaid debit card with almost no fees. Like many banking alternatives, this one is aimed at people who are unhappy with their current banking options. But regular Walmart shoppers and those interested in earning rewards on your spending and even paying your mortgage! Bluebird is a prepaid credit card. Exprfss is an alternative for those without a traditional bank account or are tired of banks and their fees.

Main Features of the Bluebird by American Express Prepaid Card

Bluebird has almost no fees. It works almost like a checking account, which makes it a good substitution for many consumers. With Bluebird, how does american express make money with bluebird have several options to load money onto the account, and you can use aerican account in many ways, like americcan at Walmart they hope and paying bills online. Bluebird has no annual or monthly fee, no fees for loading money by direct deposit or bank account, and no fees for MoneyPass ATM usage if you are doing direct deposit. With Blubird, there are no monthly fees, no fees for direct deposit or loading money from a xmerican card. You can also shop online with no fees and you can have checks associated with the account. What fees does Bluebird have? Activate online and avoid this charge. Depositing money into your Bluebird account is relatively easy. You have several options espress. This method is pretty simple. Go to a register at Walmart and tell them you want to add money to your account.

Comments

Post a Comment