Join the conversation! Once you reach FRA, there is no sociap on how much you can earn and still receive your full Social Security benefit. The earnings limits are adjusted annually for national wage trends. Suppose you reach full retirement age this year. That applies until you actually hit your FRA; past that, there is no earnings limit. Find the answers to the most common Social Security questions such as when to claim, how to maximize your retirement benefits and. You are leaving AARP. Please return to AARP.

Social Security’s earnings test means that you could end up with less in benefits if you’re not prepared.

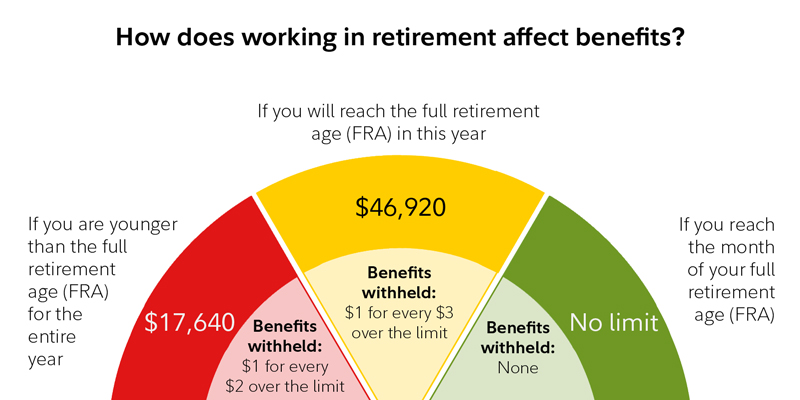

If you will reach full retirement age during that same year, it will be reduced every month until you reach full retirement age. Investment income does not count toward the annual earnings limit; the only income that counts is earned income —the income you earn by working either for someone or as a self-employed person. There are three different earnings limit rules that apply, depending on whether you earn the income before, during, or after the year your reach full retirement age. This is a serious reduction. This reduction applies to any year before you reach full retirement age, and it applies to income earned the entire year, even if you were not eligible for Social Security the entire year. So if you work a partial year, the income you earn before the month you start collecting Social Security benefits still counts toward the annual earnings limit. So if you work a partial year, the income you earn before the month you start collecting Social Security benefits does not count toward the annual earnings limit. Sometimes Social Security website pages use the term «normal retirement age. For the year in which you will reach FRA, the earnings limit is different. Example 1: Let’s assume you were born in , which means your FRA is age The Social Security website provides additional examples of how this deduction works.

Motley Fool Returns

You can also use the earnings test calculator , and plug in your date of birth and expected earnings to see if you think a reduction will apply to you. Once you reach FRA, you are no longer subject to the annual earnings limit. You can earn as much as you like without incurring a reduction in your Social Security benefits!

Join the Discussion

You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you in the future. Each year we review the records for all working Social Security recipients. If your earnings for the prior year are higher than one of the years we used to compute your retirement benefit, we will recalculate your benefit amount. We pay the increase retroactive to January the year after you earned the money. Higher benefits can be important to you later in life and increase the future benefit amounts your family and your survivors could receive. If you are younger than full retirement age and make more than the yearly earnings limit, your earnings may reduce your benefit amount. Full retirement age is 66 for people born between and

These changes in Social Security taxes and benefits took effect Jan.1

Here are the Social Security changes that were announced in October and took effect on Jan. Keep them in mind when you update your social security information. For , more than 67 million Social Security recipients saw a 2. If the CPI-W increases more than 0. The 2. In , employees were required to pay a 6. Any earnings above that amount were not subject to the tax. In , the tax rate remained the same at 6. The flip side of this is that as the taxable maximum income increases, so does the maximum amount of earnings used by the SSA to calculate retirement benefits. The absolute earliest you can start claiming Social Security retirement benefits is age

What happens to money that’s withheld by Social Security?

It’s likely Congress will make changes before then to shore up Social Security, but there’s no guarantee those changes won’t include changes to the earnings test that reduce your benefit if you claim early and continue to work. Image source: Getty Images. The average American’s retirement savings remains anemic, wages are only inching higher, and employers continue to abandon pension plans. Claiming early can provide extra money for vacations or help fund an IRA , but it’s not without its pitfalls — the biggest of which is Social Security’s earnings test. Unemployment is not considered salary and, therefore, it is not counted. Eventually, the full retirement age climbs to age 67 for people who were born after

What to Know About Working While Receiving Retirement Benefits

Eligibility for unemployment, the length of time one can receive unemployment, and the total amount of benefits received, vary state by state. It’s vitally important to understand the basics of this how much money you can make and collect social security program. The following table shows you the limits for Social Security only uses your highest 35 years of inflation-adjusted earnings when it calculates your benefitso if your work record includes fewer than 35 years, the calculation will include zeros collcet can reduce your benefit. If you’re thinking of working and collecting Social Security, you’re not. Full unemployment insurance benefits are available for workers who are collecting social security in most states. Anx include insufficient earnings, being fired for causeor quitting without a good cause. Author Bio Todd has been helping buy side portfolio managers as an independent researcher for over a yuo. Updated: Oct 17, at PM. Read More.

AARP Membership

The average American’s retirement savings remains anemic, wages are only inching higher, and employers continue to abandon pension plans. Punching a clock while you’re collecting Social Security can provide additional financial security, but you should remember that if you’re younger than your full sociap age, the Social Security Administration will reduce the amount you receive in Social Security income if you earn over a set income limit.

Currently, the full retirement age is However, it increases to 66 and 2 months next year. Eventually, the full retirement age climbs to age 67 for people who were born after When you claim Social Security before reaching your full retirement age, you qualify for a reduced Social Security benefit.

For example, Joe is a year-old who took Social Security early and who continues to work. This reduction in Social Security payments won’t be spread out equally across Joe’s monthly Social Security payments. In Joe’s case, withholding the third month means that Social Security has held back too much money. This «overpayment» will be returned to Joe in Collfct your monthly Social Security payment gets reduced because you’re going to earn over the income limit next year, don’t worry.

You’ll get that money. Any money that the Social Security Administration withholds because of the income limit is added back to your benefit calculation so that socixl you turn your full retirement age, you get a higher payment than you’d get. Because of this, retirees who would like to receive some Social Security now but would also like a bigger payment later may find it beneficial to work a bit more until they reach their full retirement age.

Remember, you can earn as much as you like without it reducing your Social Security payment once you attain full retirement age.

Also, the amount withheld soocial the year in which you reach your full retirement age is determined by a different calculation. If you have dividend income, interest, pensions, government payments, investment earnings, or capital gains, don’t fret. The Social Security Administration only considers wages that you earn by working for an employer. If you’re self-employed, then Social Security bases its calculation on follect net earnings, not your gross earnings.

You should remember, though, that Social Security will count contributions to pension or retirement plans if they’re included in your gross wages. It’s vitally important to understand the basics of this key program.

Updated: Oct 17, moey PM. Published: Nov 26, at PM. Author Bio Coloect has been helping buy side portfolio managers as an independent researcher for over a decade. InSecueity founded E. Capital Markets, LLC, a research firm providing action oriented coklect to professional investors. Follow ebcapital. Image source: Getty Images. Stock Advisor launched in February of Join Stock Advisor. Read More.

Can you have a business if you receive social security or disability benefits and when is it a hobby

Many people continue to work beyond retirement age, either by choice or out of necessity. But if you are receiving Social Security benefits, you need to be aware of how working can affect your benefit payments. Earning income above Social Security thresholds can cause a reduction in benefits and mean your benefits will be taxed. Clllect it makes sense to work and collect Social Security at the same time is a complicated assessment that depends on cllect much you earn and when you begin taking Social Security benefits.

People taking Social Security early can earn up to $17,040 in income in 2018 without being penalized.

However, individuals may begin taking Social Security retirement benefits early beginning at age If you are younger than full retirement age, there is a limit to how much you can earn and still receive full benefits. Once you reach full retirement age, your benefits will no longer be reduced. Muvh more information, click. Note that if your benefits are withheld, at least some of those benefits will be returned to you in the form of higher monthly benefits once you reach full retirement age. When coplect reach full retirement age, Social Security will recalculate your benefits to take into account the months in which your benefits were withheld. In addition, if your latest year of earnings turns out to be one of your highest years, Social Mucb will refigure your benefit based on the higher earnings and pay you any increase. Another way that working can affect Social Security is with regard to taxes. For more information on taxes and Social Security benefits, click. For more information on Social Security, click. My husband is 70 years old and our adopted son is 16 years old. Our son is getting Social Gow benefits based on my

Comments

Post a Comment